Pearson is a company that thrives on the power of a good story. We use stories every day to teach children, enlighten business people and entertain book readers. We also use them in our business to learn from the past as we take on the future.

This year one of our most famous brands, Penguin, celebrates its 70th birthday - after seven decades packed with stories and lessons. One example: E.V. Rieu was hired by Penguin's founder Allen Lane to launch the Penguin Classics. He did it well, and when he retired he wrote: 'The Penguin Classics, though I designed them to give pleasure even more than instruction, have been hailed as the greatest educative force of the twentieth century. And far be it for me to quarrel with that encomium, for there is no one whom they have educated more than myself.'

All of us in Pearson could say that today. In trying to educate, entertain and inform, the 33,000 people here are trying to be a great educative force in the twenty-first century. In the process, we're constantly learning ourselves.

Eight years ago we started some radical editing of 160-year-old Pearson. We wanted to recompose it as a company with industrial logic - businesses that were in the same general field and could thus share assets and operations as well as culture and style.

Our business objective was to be a high-performing, durable company that could take advantage of the best growth markets. Our social objective was to help people move on in their lives intellectually and professionally - to 'live and learn'.

We focused on a few simple things:

The proof of the success of our strategy would be increasing the value of the company for its owners. Here's how I see our report card:

1. Financial performance For four years (1997-2000) we made good strategic and financial progress. By 2000 we had largely finished reshaping our set of businesses (though we're never really finished). We had steadily rising sales, margins and cash, and of course a large boom (and soon-to-be bust) in the internet.

Then we suffered a sharp downturn in business advertising and technology which hurt financial returns, in our newspapers in particular. We also saw US school budgets struggle with state budget deficits; the US dollar weaken; consumer book buying lag.

So we began a second chapter for Pearson, this time to improve our operational fitness - taking out costs and changing the way we did things to become more efficient. At the same time, we stuck to our financial goals, restating them slightly in 2001 to 'earnings, cash and return on invested capital' to adjust to our new phase of development.

At the end of those three years - chapter two - adjusted earnings per share are up 40%; free cash flow is up 106%; and return on invested capital is up 1.6 percentage points.

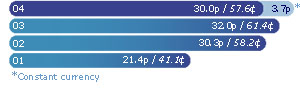

Our progress In 2004 we increased our adjusted eps by 5% on an underlying basis. Currency movements eroded our reported performance by 3.7p. In 2005 we expect strong earnings growth.

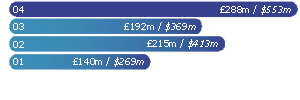

Our progress Our cash improved by £96m, helped by the receipt of the TSA payment in December 2004. We expect our free cash flow to increase further in 2005.

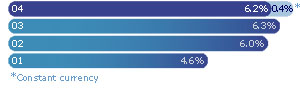

Our progress Reported ROIC was a little lower than in 2003 at 6.2% but it rose again on an underlying basis. This was the result of improvements in operating profit and working capital efficiency. We expect further improvement on ROIC in 2005.

2. Strategic logic We now have a coherent, complementary set of businesses, all with the objective of adding value to words, stories or data, and all with market leadership, scale and brands:

These businesses now share a company culture that is enthusiastic, self-confident and collaborative. They also share central business and supply chain services and work together on anything that will reduce costs or add quality or help us invent new products. In 2003 and 2004 alone we generated some $500m of revenues and $100m of cash savings through that kind of cost and revenue collaboration.

Going into 2005, our objective is the same as it has been for the past eight years: to create wealth for our owners by adding value to words and data and helping people get on in their lives. We think that's an excellent focus for two reasons:

1. Because of the trends we see in the world The demand for education and personal development is a worldwide movement. School and college enrolments are growing. Countries realise that educated citizens foster economic progress and democracy; individuals realise that they can't advance in a knowledge economy without education.

In much of the world, that demand starts with a desire to learn English, the language of international business and politics. That's increasingly important to market economies that want to promote inward investment, and it creates growing markets in Europe and the USA, as well as in the emerging giants of India and China.

2. Because we have competitive advantages Our greatest advantage is our people. At the centre of the company is knowledge of how to manage the financial, legal and creative issues that make great publishing by talented people commercial.

Secondly, everything we make and sell (education, journalism, commentary and literature) requires the company to value independence of thought and openmindedness, and it takes special care and skill to turn that into value for shareholders.

Next is our scale. We are twice as large as any other publishing company. That gives us clout with retailers, distributors, suppliers - all the links up and down our supply chain. That scale has come through aggressive consolidation in geographic and functional areas to achieve operational efficiency. Over the past four years, we've reduced costs by close to £400m in all our businesses.

Our focus on utility also makes us stand out. People have learned that technology can allow them to have things just as they want them: so they want what they buy to be tailored for them, to solve their problem. In education, we're slowly becoming famous for our content-plus-applications approach: for insisting, for instance, that what we produce is not just a book, but a way of helping a teacher teach and a student learn. In newspapers, particularly their online versions, it also helps to be able to offer news and analysis on the topic a reader chooses, in his own way.

Finally, in every one of our divisions, breadth is an advantage. It puts us in the position to be innovative. We can try market-changing ideas others can't because we have parts of the puzzle that no one else has and a wider range of products and markets to spread the costs of exploiting them over. That gives us leeway to try out something new without risking our business.

That strategy and those advantages helped us move ahead in 2004. We made progress on all our financial goals. It was a low point for the US school market and a tough year for Penguin. But all the same, we improved our earnings by 5%, our cash flow by almost 50% and our return on invested capital from 6.3% to 6.6% at constant currency. Those results were thanks to some outstanding efforts all around Pearson, among them:

At the start of 2005, we're beginning to write the next chapter in Pearson's history. We can now begin to see our efforts in the first two chapters paying off. Our improved efficiency and productivity and our strong products and services are now combining with more healthy markets in 2005 and the years to follow.

The market for business advertising is slowly recovering and the US school market is entering a phase of buoyant new business opportunity. Some of our biggest profit contributors - Higher Education and IDC - see steady growth in their markets while some emerging businesses - in international education, government services and testing - are preparing for rapid growth. All around Pearson, our customers are asking for the changes in our products and services we've been planning for some time - changes driven by the use of technology and the demand for personalisation in particular.

Almost all of the people in Pearson are owners of a stake in the company, like you. In 2005 we are all applying our determination and ingenuity - and no small amount of grit - to make sure that this new chapter in our history makes happy reading for all Pearson shareholders.

Marjorie Scardino, Chief Executive