In 2004, we set out to achieve underlying progress on our three financial measures: adjusted earnings per share, free cash flow and return on invested capital. We are pleased to report that we made that progress, even in a weak market for the US school industry and a tough year for Penguin. We also made further efficiency gains and product investments, which have set the stage for significant progress in 2005 and beyond as our market conditions improve.

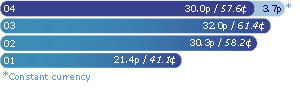

Pearson's sales rose 3% in 2004, with solid growth at Pearson Education and IDC. Adjusted operating profit increased 7%, with a 24% decline at Penguin being more than offset by good progress at our largest business, Pearson Education (up 5%) and a significant profit improvement at the FT Group (up 69%). Adjusted earnings per share of 30.0p (2003: 32.0p) were up 5% on an underlying basis, helped by this profit improvement and by lower tax and interest charges.

Our reported results were once again affected by currency movements. We earn approximately two-thirds of our sales in the US and the weakening of the dollar against the pound (£1:$1.83 in 2004 against £1:$1.63 in 2003) reduced our reported sales by £302m and our reported operating profit by £51m for our continuing businesses.

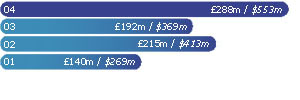

Our cash flow progressed with total free cash flow rising by £96m to £288m, representing a cash conversion rate of 93%. Average working capital:sales at Pearson Education and Penguin - our working capital users - improved by half a percentage point to 32.3%. Efficiency improvements more than offset an increase in product investment and the start-up of new contracts.

We ended the year with net debt of £1,206m, an 11% improvement on 2003.

Our statutory results also showed an improvement with operating profit rising 2% and statutory basic earnings per share increasing to 11.1p from 6.9p in 2003.

The board is proposing a dividend increase of 5% to 25.4p for the full year.

Our progress We increased our adjusted eps by 5% on an underlying basis. Currency movements eroded our reported performance by 3.7p. In 2005 we expect strong earnings growth.

Our progress Our cash improved by £96m, helped by the receipt of the TSA payment in December 2004. We expect our free cash flow to increase further in 2005.

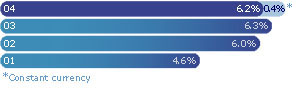

Our progress Reported ROIC was a little lower than in 2003 at 6.2%, but it rose again on an underlying basis. This was the result of improvements in operating profit and working capital efficiency. We expect further improvement in ROIC in 2005.

Rona Fairhead, Chief financial officer