The directors' remuneration report is presented to shareholders by the board. This report complies with the Directors' Remuneration Report Regulations 2002. This report also sets out how the principles of the Combined Code relating to directors' remuneration are applied.

A resolution will be put to shareholders at the annual general meeting on 29 April 2005 inviting them to consider and approve this report.

Reuben Mark chairs the personnel committee; the other members of the committee during 2004 were Terry Burns and Rana Talwar. All three members of the committee are independent non-executive directors. The committee's terms of reference are set out on the company's website.

Dennis Stevenson, chairman, Marjorie Scardino, chief executive, David Bell, director for people, and Robert Head, compensation and benefits director, provided material assistance to the committee during the year. They attend meetings of the committee, although no director is present when his or her own position is being considered.

To ensure that it received independent advice, the committee has appointed Towers Perrin to supply survey data and advise on market trends, long-term incentives and other general remuneration matters. Towers Perrin also advised the company on health and welfare benefits in the US.

The committee believes that the company has complied with the provisions regarding remuneration matters of the Combined Code on corporate governance as required by the UK Listing Authority of the Financial Services Authority.

The items subject to audit in this report comprise the sections on directors' remuneration, directors' pensions and movements in directors' interests in restricted shares and share options set out in tables 1, 2, 4 and 5 together with the accompanying notes set out below.

This report sets out the company's policy on directors' remuneration.This policy will continue to apply to each director for 2005 and, so far as practicable, for subsequent years. The committee considers that a successful remuneration policy needs to be sufficiently flexible to take account of future changes in the company's business environment and in remuneration practice. Any changes in policy for years after 2005 will be described in future reports, which will continue to be subject to shareholder approval. All statements in this report in relation to remuneration policy for years after 2005 should be considered in this context.

Pearson seeks to generate a performance culture by operating programmes that support its business goals and reward their achievement. It is the company's policy that total remuneration (base compensation plus short- and long-term incentives) should reward both short- and long-term results, delivering competitive rewards for target performance, but outstanding rewards for exceptional company performance.

The company's policy is that base compensation should provide the appropriate rate of remuneration for the job, taking into account relevant recruitment markets and business sectors and geographic regions. Benefit programmes should ensure that Pearson retains a competitive recruiting advantage.

Share ownership is encouraged throughout the company. Equity-based reward programmes align the interests of directors, and employees in general, with those of shareholders by linking rewards with Pearson's financial success.

The committee selects performance measures and establishes targets for the company's various performance-related annual or long-term incentive plans based on appropriate independent advice and an assessment of the interests of shareholders and the company and taking into account an appropriate balance of risk and reward for the directors and other participants.

The committee determines whether or not targets have been met under the company's various performance related annual or long-term incentive plans based on the relevant information and input from advisers and auditors as appropriate.

We set out below Pearson's total shareholder return performance relative to the FTSE All-Share index (of which Pearson is a constituent) on an annual basis over the five-year period 1999 to 2004. We have chosen this index on the basis that it is a recognisable reference point and appropriate comparator for the majority of our investors.

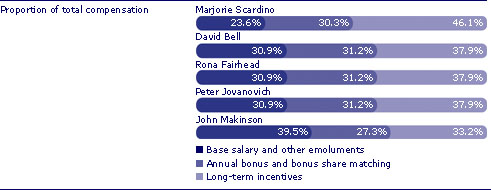

Total remuneration is made up of fixed and performance-linked elements. Consistent with its policy, the committee places considerable emphasis on the performance-linked elements i.e. annual bonus, bonus share matching and long-term incentives.

Based on the details set out in this report, our policy is that the relative importance of fixed and performance related remuneration for each of the directors should be as follows:

The committee will continue to review the mix of fixed and performance-linked remuneration on an annual basis consistent with its overall philosophy.

Our policy is that the base salaries of the executive directors should be competitive with those of directors and executives in similar positions in comparable companies. We use a range of companies of comparable size and global reach in different sectors including the media sector in the UK and selected media companies in North America to make this comparison. We use these companies because they represent the wider executive talent pool from which we might expect to recruit externally and the pay market to which we might be vulnerable if our salaries were not competitive.

Our policy is to review salaries annually.

It is the company's policy that its benefit programmes should be competitive in the context of the local labour market, but as an international company we recognise the requirements, circumstances and mobility of individual executives.

The committee establishes the annual bonus plans for the executive directors and the chief executives of the company's principal operating companies, including performance measures and targets and the amount of bonus that can be earned.

The performance measures relate to the company's main drivers of business performance at both the corporate and operating company level. Performance is measured separately for each item. For each performance measure, the committee establishes performance thresholds, targets and maxima for different levels of payout.

For 2005, the performance measures for Pearson plc are sales, growth in underlying adjusted earnings per share, cash flow and working capital as a ratio to sales. For subsequent years, the measures will be set at the time.

For 2005, the committee reviewed the target annual bonus opportunity for the CEO, based on an assessment of market practice by Towers Perrin, and increased it from 75% to 100% of base salary. The committee is satisfied with the CEO's resulting target total direct compensation relative to the market and the increase in the proportion of her compensation that is performance-related. The target annual incentive opportunity for the other executive directors and other members of the Pearson Management Committee remains 75% of salary. The maximum bonus for performance in excess of target remains in all cases, including the CEO, 150% of salary.

The committee may award individual discretionary bonuses.

Details of actual pay-outs for 2004, which averaged 107% of salary, are set out in table 1 and the notes.

The committee will continue to review the bonus plans on an annual basis and to revise the bonus limits and targets in light of the current conditions.

In the UK, bonuses do not form part of pensionable earnings. In the US, bonuses up to 50% of base salary are pensionable under the supplemental executive retirement plan, consistent with US market practice.

The company encourages executive directors and other senior executives to hold Pearson shares.

The annual bonus share matching plan permits executive directors and senior executives around the company to invest up to 50% of any after tax annual bonus in Pearson shares. If these shares are held and the company's adjusted earnings per share increase in real terms by at least 3% per annum, the company will match them on a gross basis of one share for every two held after three years, and another one for two originally held (i.e. a total of one-for-one) after five years. This measure of performance is consistent with the test of company performance used in the executive option plan.

Real growth is measured against the UK Government's Index of Retail Prices (All Items). We chose to test our earnings per share growth against UK inflation over three and five years to measure the company's financial progress over the period to which the entitlement to matching shares relates.

Executive directors, senior and other executives and managers are eligible to participate in Pearson's long-term incentive plan introduced in 2001. The plan consists of two parts: stock options and/or restricted stock. The aim is to give the committee a range of tools with which to link corporate performance to management's long-term reward in a flexible way. The principles underlying it are as follows:

The vesting of restricted stock is normally dependent on the satisfaction of a stretching corporate performance target as determined by the committee for each award. Restricted stock may be granted without performance conditions to satisfy recruitment and retention objectives. Following comments received from some of our shareholders in relation to the performance measures used as part of the long-term incentive plan and having consulted a number of our larger shareholders and their representatives, the committee reviewed the conditions that would apply for the 2004 award and subsequently. The performance measures governing awards of restricted stock are relative total shareholder return, return on invested capital, and an earnings per share and sales growth matrix.

The committee chose total shareholder return relative to the FTSE World Media Index because, in line with many of our shareholders, it felt that part of executive directors' rewards should be related to performance relative to the company's peers.

We chose return on invested capital, which is defined as operating profit net of 15% cash tax divided by net operating assets plus gross goodwill (pre-amortisation), because, over the past few years, the transformation of Pearson has significantly increased the capital invested in the business (mostly in the form of goodwill associated with acquisitions) and required substantial cash investment to integrate those acquisitions.

A sales and earnings per share growth matrix was chosen because strong top-line and bottom-line growth are imperative if we are to improve our total shareholder return and our return on invested capital.

Details of the performance periods, measures and targets for the 2004 and other outstanding restricted stock awards are set out in the notes to table 4.

Within the 10% limit on the issue of new equity, up to 1.5% may be placed under option in any year. No options may be granted unless our adjusted earnings per share increase in real terms by at least 3% per annum over the three-year period prior to grant. Grants may be made at the maximum level only if real earnings per share growth exceeds 3% per annum by a substantial margin. Real growth is measured against the UK Government's Index of Retail Prices (All Items).

This performance test is designed to provide a direct link between the amount of equity allocated to option grants and the company's financial progress. Earnings per share growth was chosen as the most appropriate measure of our ability to fund the issue of new equity and we chose to test our earnings per share growth against UK inflation over three years to ensure that option funding is released only when the real value of shareholders' earnings has increased over a sustained period.

Having consulted institutional investors, we chose a pre-grant performance condition because we operate in a global environment where pre-exercise performance conditions are not common. Accordingly, there are no further performance conditions governing the exercise of options.

The real growth in earnings per share test for the three-year periods ending 2001, 2002 and 2003 were not met. The target for the increase in adjusted earnings per share from 2001 to 2004 for the company to be able to grant stock options in 2005 was 18.5% i.e. inflation of 9.5% plus 3% per annum real growth. The increase in adjusted earnings per share over the period has actually been 40.2% meaning this target has been met.

For 2005, the committee will therefore be able to make awards under the long-term incentive plan in the form of both restricted stock and stock options although, at the date of publication of this report, no decision had been made.

Executive directors are eligible to participate in the company's all-employee share plans on the same terms as other employees. These plans comprise share acquisition programmes in the UK and the US. These plans operate within specific tax legislation (including a requirement to finance acquisition of shares using the proceeds of a monthly savings contract) and the acquisition of shares under these plans is not subject to the satisfaction of a performance target.

As previously noted, in line with the policy of encouraging widespread employee ownership, the company encourages executive directors to build up a substantial shareholding in the company. Although, in view of the volatility of the stock market, we do not think it is appropriate to specify a particular relationship of shareholding to salary, we describe separately here both the number of shares that the executive directors and the chairman hold and the value expressed as a percentage of base salary.

The current value of holdings based on the middle market value of Pearson shares of 652p on 25 February 2005 against the base salary set out in this report is as follows:

| Number of shares |

Value (% of base salary) |

|

|---|---|---|

| Dennis Stevenson | 167,043 | 335% |

| Marjorie Scardino | 127,761 | 129% |

| David Bell | 77,305 | 134% |

| Rona Fairhead | 12,710 | 21% |

| Peter Jovanovich | 86,461 | 119% |

| John Makinson | 115,898 | 164% |

For health reasons, Peter Jovanovich stood down as a director of the company on 31 January 2005, but remains entitled to contractual short- and long-term disability and other benefits. These arrangements are set out in an agreement dated 28 January 2005.

In accordance with policy, all continuing executive directors have rolling service agreements with one or more group companies under which, other than by termination in accordance with the terms of these agreements, employment continues until retirement.

These service agreements provide that the company may terminate these agreements by giving 12 months' notice and specify the compensation payable by way of liquidated damages in circumstances where the company terminates the agreements without notice or cause. We feel that these notice periods and provisions for liquidated damages are adequate, but not excessive, compensation for loss of office.

We summarise the service agreements that applied during 2004 and that continue to apply for 2005 (or in the case of Peter Jovanovich that applied to 31 January 2005) as follows:

| Name | Date of agreement | Notice periods | Compensation on termination by the company without notice or cause |

|---|---|---|---|

| Dennis Stevenson | 13 May 1997 | Six months from the director; 12 months from the company | 100% of salary at the date of termination |

| Marjorie Scardino | 27 February 2004 | Six months from the director; 12 months from the company | 100% of annual salary at the date of termination, the annual cost of pension and all other benefits and 50% of potential bonus |

| David Bell | 15 March 1996 | Six months from the director; 12 months from the company | 100% of annual salary at the date of termination, the annual cost of pension and all other benefits and 50% of potential bonus |

| Rona Fairhead | 24 January 2003 | Six months from the director; 12 months from the company | 100% of annual salary at the date of termination, the annual cost of pension and all other benefits and 50% of potential bonus |

| Peter Jovanovich | 9 October 2000 (for service to 31 January 2005) | Employment may be terminated by either party at any time, subject to three months' notice from the director in the case of voluntary resignation | 200% of annual salary and target bonus |

| John Makinson | 24 January 2003 | Six months from the director; 12 months from the company | 100% of annual salary at the date of termination, the annual cost of pension and all other benefits and 50% of potential bonus |

We describe the retirement benefits for each of the executive directors. Details of directors' pension arrangements are set out in table 2.

Executive directors participate in the approved pension arrangements set up for Pearson employees. Marjorie Scardino, John Makinson, Rona Fairhead and Peter Jovanovich will also receive benefits under unapproved arrangements because of the cap on the amount of benefits that can be provided from the approved arrangements in the US and the UK.

The pension arrangements for all the executive directors include life insurance cover whilst in employment, and entitlement to a pension in the event of ill-health or disability. A pension for their spouse and/or dependants is also available on death.

In the US, the approved defined benefit arrangement is the Pearson Inc. Pension Plan. This plan provides a lump sum convertible to a pension on retirement. The lump sum accrued at 6% of capped compensation until 31 December 2001 when further benefit accruals ceased. Normal retirement is age 65 although early retirement is possible subject to a reduction for early payment. No increases are guaranteed for pensions in payment. There is a spouse's pension on death in service and the option to provide a death in retirement pension by reducing the member's pension.

The approved defined contribution arrangement in the US is a 401(k) plan. At retirement, the account balances will be used to provide benefits. In the event of death before retirement, the account balances will be used to provide benefits for dependants.

In the UK, the approved scheme is the Pearson Group Pension Plan and executive directors participate in the Final Pay section. Normal retirement age is 62 but, subject to company consent, retirement is possible after age 50. The accrued pension is reduced on retirement prior to age 60. Pensions in payment are guaranteed to increase each year at 5% or the increase in the Index of Retail Prices, if lower. Pensions for a member's spouse, dependent children and/or nominated financial dependant are payable in the event of death.

Marjorie Scardino participates in the Pearson Inc. Pension Plan and the approved 401(k) plan. Additional pension benefits will be provided through an unfunded unapproved defined contribution plan and a funded defined contribution plan approved by the UK Inland Revenue as a corresponding scheme to replace part of the unfunded plan. The account balance of the unfunded unapproved defined contribution plan is determined by reference to the value of a notional cash account that increases annually by a specified notional interest rate. This plan provides the opportunity to convert a proportion of this notional cash account into a notional share account reflecting the value of a number of Pearson ordinary shares. The number of shares in the notional share account is determined by reference to the market value of Pearson shares at the date of conversion.

David Bell is a member of the Pearson Group Pension Plan. He is eligible for a pension of two-thirds of his final base salary at age 62 due to his long service but early retirement with a reduced pension before that date is possible, subject to company consent.

Rona Fairhead is a member of the Pearson Group Pension Plan. Her pension accrual rate is 1/30th of pensionable salary per annum, restricted to the earnings cap introduced by the Finance Act 1989. The company also contributes to a Funded Unapproved Retirement Benefits Scheme (FURBS) on her behalf. In the event of death before retirement, the proceeds of the FURBS account will be used to provide benefits for her dependants.

Peter Jovanovich is a member of the Pearson Inc. Pension Plan and the approved 401(k) plan. He also participates in an unfunded, unapproved Supplemental Executive Retirement Plan (SERP) that provides an annual accrual of 2% of final average earnings, less benefits accrued in the Pearson Inc. Pension Plan and US Social Security. He ceased to build up further benefits in the SERP at 31 December 2002. Additional defined contribution benefits are provided through a funded, unapproved 401(k) excess plan and an unfunded, unapproved arrangement. In the event of death while in receipt of disability benefits, the account balances in the defined contribution arrangements will be used to provide benefits for dependants. The SERP arrangement provides a spouse's pension on death while in receipt of disability benefits and the option of a death in retirement pension by reducing the member's pension.

John Makinson is a member of the Pearson Group Pension Plan under which his pensionable salary is restricted to the earnings cap. The company ceased contributions on 31 December 2001 to his FURBS arrangement. During 2002 it set up an Unfunded Unapproved Retirement Benefits Scheme (UURBS) for him. The UURBS tops up the pensions payable from the Pearson Group Pension Plan and the closed FURBS to target a pension of two-thirds of a revalued base salary on retirement at age 62. The revalued base salary is defined as £450,000 effective at 1 June 2002, increased at 1 January each year by reference to the increase in the Index of Retail Prices. In the event of his death a pension from the Pearson Group Pension Plan, the FURBS and the UURBS will be paid to his spouse or nominated financial dependant. Early retirement is possible from age 50, with company consent. The pension is reduced to reflect the shorter service, and before age 60, further reduced for early payment.

Our policy is that executive directors may, by agreement with the board, serve as non-executives of other companies and retain any fees payable for their services.

Our policy is that the chairman's pay should be set at a level that is competitive with those of chairmen in similar positions in comparable companies.

He is not entitled to an annual bonus, retirement or other benefits. He is eligible to participate in the company's worldwide save for shares plan on the same terms as all other eligible employees.

For 2004, the committee's view was that, taking into account the remuneration of chairmen in comparable positions, the appropriate total pay level was £425,000 per year.

Having been informed of the committee's view, the chairman indicated that he thought it was not appropriate for him to receive an increase of this magnitude in cash - a view that the committee accepted. Instead, the committee recommended to the board that the chairman's salary should be £325,000 for 2004, an increase of £50,000, and that he should receive a one-off restricted share award of 30,000 shares. This award is linked to the company's share price and will not be released to him unless the Pearson share price reaches £9.00 within a maximum period of three years.

For 2005, the committee recommended to the board that the chairman's salary should be increased towards the appropriate total pay level of £425,000 previously noted and that this increase should be delivered in Pearson shares purchased in the market at the prevailing share price. No awards of performancerelated restricted shares will be granted. Full details will be set out in the report on directors' remuneration for 2005.

Fees for non-executive directors are determined by the full board having regard to market practice and within the restrictions contained in the company's articles of association. Non-executive directors receive no other pay or benefits (other than reimbursement for expenses incurred in connection with their directorship of the company) and do not participate in the company's equity-based incentive plans.

For 2004, the non-executive directors received an annual fee of £35,000 each. Two non-UK based directors were paid a supplement of £7,000 per annum. The non-executive directors who chaired the personnel and audit committees each received an additional fee of £5,000 per annum.

In the case of Patrick Cescau, his fee was paid over to his employer. For those non-executive directors who retained their fees personally, £10,000 of the total fee, or all of the fee in the case of Rana Talwar, was payable in the form of Pearson shares which the non-executive directors have committed to retain for the period of their directorships.

For 2005, the chairman and the executive directors of the board reviewed the level and structure of non-executive directors' fees, which had not been changed since January 2000. After reviewing external benchmarks, they agreed an increase in the basic fee, an increase in the fee for the committee chairmen, the introduction of separate fees for committee membership and the senior independent director and the replacement of the fee for non-UK based directors with a fee for overseas meetings. One-third of the basic fee will be paid in Pearson shares. Full details will be set out in the report on directors' remuneration for 2005.

Non-executive directors serve Pearson under letters of appointment and do not have service contracts. There is no entitlement to compensation on the termination of their directorships.

| All figures in £000s | 2004 Salaries/fees |

2004 Bonus |

2004 Other |

2004 Total |

2003 Total |

|---|---|---|---|---|---|

| Chairman | |||||

| Dennis Stevenson | 325 | - | - | 325 | 275 |

| Executive directors | |||||

| Marjorie Scardino | 645 | 831 | 62 | 1,538 | 879 |

| David Bell | 375 | 483 | 16 | 874 | 491 |

| Rona Fairhead | 390 | 503 | 14 | 907 | 493 |

| Peter Jovanovich | 473 | 571 | 8 | 1,052 | 695 |

| John Makinson | 460 | 119 | 212 | 791 | 809 |

| Non-executive directors | |||||

| Terry Burns | 35 | - | - | 35 | 35 |

| Patrick Cescau | 35 | - | - | 35 | 35 |

| Susan Fuhrman (appointed 27 July 2004) | 18 | - | - | 18 | - |

| Reuben Mark | 47 | - | - | 47 | 47 |

| Vernon Sankey | 40 | - | - | 40 | 40 |

| Rana Talwar | 35 | - | - | 35 | 35 |

| Total | 2,878 | 2,507 | 312 | 5,697 | 3,834 |

| Total 2003 | 2,795 | 714 | 325 | - | 3,834 |

Note 1 For Marjorie Scardino, David Bell and Rona Fairhead, bonuses were related to the performance of Pearson plc.

In the case of Peter Jovanovich and John Makinson, part of their bonuses related to the performance of Pearson Education and Penguin Group respectively and part to the performance of Pearson plc.

For Pearson plc, growth in adjusted earnings per share at constant exchange rates and average working capital as a ratio to sales were above maximum, and growth in underlying sales and operating cash conversion were above target but below maximum.

For Pearson Education, average working capital as a ratio to sales and operating cash conversion were above maximum, and sales and operating margin were above target but below maximum.

For Penguin Group, growth in underlying sales, operating margin, working capital as a ratio to sales and operating cash conversion were below threshold.

In the case of Pearson plc and Pearson Education, cash received in 2004 in relation to the outstanding receivable due from the TSA contract in 2002 was not included for bonus purposes.

Note 2 Other emoluments include company car and healthcare benefits and, in the case of Marjorie Scardino, include £37,955 in respect of housing costs. John Makinson is entitled to a location and market premium in relation to the management of the business of the Penguin Group in the US. He received £184,517 for 2004. Marjorie Scardino, Rona Fairhead, David Bell and John Makinson have the use of a chauffeur.

Note 3 No amounts in compensation for loss of office and no expense allowances chargeable to UK income tax were paid during the year.

Note 4 The following executive directors served non-executive directorships elsewhere and received fees as follows:Marjorie Scardino (Nokia Corporation - €100,000); David Bell (VITEC Group plc - £28,750); Rona Fairhead (Harvard Business School Publishing - nil, HSBC Holdings plc - £58,334); John Makinson (George Weston Limited - C$73,000).

| Age at 31 Dec 04 | Increase in accrued pension over the period £000 |

Accrued pension at 31 Dec 04 £0001 |

Transfer value at 31 Dec 03 £0002 |

Transfer value at 31 Dec 04 £000 |

Increase in transfer value† £000 |

Increase in accrued pension over the period* £000 |

Transfer value of increase in accrued pension at 31 Dec 04*† £000 |

Other pension costs to the company over the period £0003 |

Other pension related benefits £0004 |

|

|---|---|---|---|---|---|---|---|---|---|---|

| Marjorie Scardino | 57 | (0.2) | 3.8 | 30.2 | 29.5 | (0.7) | (0.3) | (2.3) | 487.0 | 26.1 |

| David Bell | 58 | 17.3 | 233.3 | 2,805.7 | 3,311.9 | 487.5 | 10.6 | 132.2 | - | - |

| Rona Fairhead | 43 | 3.4 | 10.7 | 44.2 | 69.1 | 19.9 | 3.2 | 15.7 | 101.4 | - |

| Peter Jovanovich | 55 | (4.2) | 57.4 | 442.3 | 404.5 | (37.8) | (6.1) | (43.0) | 241.4 | 0.8 |

| John Makinson | 50 | 17.7 | 149.9 | 1,189.2 | 1,438.3 | 244.1 | 13.5 | 125.0 | - | 4.2 |

*Net of inflation

†Less directors' contributions

Note 1 The accrued pension at 31 December 2004 is that which would become payable from normal retirement age if the member left service at 31 December 2004. For Marjorie Scardino it relates only to the pension from the US Plan and the impact is negative because of exchange rate changes over the year. For David Bell and Rona Fairhead it relates to the pension payable from the UK Plan. For Peter Jovanovich it relates to the pension from the US Plan and the US SERP and the impact is negative because of exchange rate changes over the year. For John Makinson it relates to the pension from the UK Plan, the FURBS and the UURBS in aggregate.

Note 2 The UK transfer values at 31 December 2004 are calculated using the assumptions for cash equivalents payable from the UK Plan and are based on the accrued pension at that date. For the US SERP, transfer values are calculated using a discount rate equivalent to current US government long-term bond yields. The US Plan is a lump sum plan and the accrued balance is shown.

Note 3 This column comprises pension supplements for UK benefits, company contributions to funded defined contribution plans and notional contributions to unfunded defined contribution plans.

Note 4 This column comprises life cover and long-term disability insurance not provided by the retirement plans.

| Ordinary shares at 1 Jan 04 | Ordinary shares at 31 Dec 04 | |

|---|---|---|

| Dennis Stevenson | 163,268 | 167,043 |

| Marjorie Scardino | 93,733 | 127,761 |

| David Bell | 56,492 | 77,305 |

| Terry Burns | 3,133 | 4,089 |

| Patrick Cescau | - | - |

| Rona Fairhead | 9,622 | 12,710 |

| Susan Fuhrman | - | 551 |

| Peter Jovanovich | 56,450 | 86,461 |

| John Makinson | 39,214 | 115,898 |

| Reuben Mark | 13,561 | 14,798 |

| Vernon Sankey | 2,992 | 3,943 |

| Rana Talwar | 4,346 | 8,152 |

Note 1 Ordinary shares includes both ordinary shares listed on the London Stock Exchange and American Depositary Receipts (ADRs) listed on the New York Stock Exchange. The figures include both shares and ADRs acquired by individuals investing part of their own after-tax bonus in Pearson stock under the annual bonus share matching plan.

Note 2 Executive directors of the company, as possible beneficiaries, are also deemed to be interested in the Pearson Employee Share Trust and the Pearson Employee Share Ownership Trust, the trustees of which held 82,840 and 6,774,054 Pearson ordinary shares of 25p each respectively at 31 December 2004 and also at 28 February 2005.

Note 3 At 31 December 2004,Marjorie Scardino, John Makinson and David Bell each held 1,000 shares in Recoletos Grupo de Comunicación S.A. Dennis Stevenson held 8,660 shares. John Makinson held 1,000 shares in Interactive Data Corporation.

Note 4 From 2004,Marjorie Scardino is also deemed to be interested in a further number of shares under her unfunded pension arrangement described in Retirement benefits of this report, which provides the opportunity to convert a proportion of her notional cash account into a notional share account reflecting the value of a number of Pearson shares.

Note 5 The register of directors' interests (which is open to inspection during normal office hours) contains full details of directors' shareholdings and options to subscribe for shares. The market price on 31 December 2004 was 628.5p per share and the range during the year was 579p to 681.5p.

| Date of award | 1 Jan 04 | Awarded | Released | Lapsed | 31 Dec 04 | Market value at date of award | Latest vesting date | Date of release | Price paid on release |

|---|---|---|---|---|---|---|---|---|---|

| Dennis Stevenson | |||||||||

| c 5/5/04 | 30,000 | 30,000 | 673.5p | 5/5/07 | |||||

| Total | - | 30,000 | - | - | 30,000 | ||||

| Marjorie Scardino | |||||||||

| a 8/6/99 | 54,029 | 54,029 | - | 8/6/04 | 0p | ||||

| b 19/5/00 | 13,676 | 13,676 | - | ||||||

| b 11/5/01 | 14,181 | 14,181 | |||||||

| c* 9/5/01 | 55,400 | 16,343 | 39,057 | ||||||

| c 16/12/02 | 362,040 | 362,040 | |||||||

| c 26/9/03 | 144,240 | 144,240 | |||||||

| c 21/12/04 | 416,130 | 416,130 | 613p | 21/12/07 | |||||

| Total | 643,566 | 416,130 | 54,029 | 30,019 | 975,648 | ||||

| David Bell | |||||||||

| a 8/6/99 | 26,890 | 26,890 | - | 8/6/04 | 0p | ||||

| b 19/5/00 | 6,371 | 6,371 | - | ||||||

| b 11/5/01 | 6,371 | 6,371 | |||||||

| b 17/4/03 | 6,105 | 6,105 | |||||||

| b 16/4/04 | 4,503 | 4,503 | 652p | 16/4/09 | |||||

| c* 9/5/01 | 21,800 | 6,431 | 15,369 | ||||||

| c 16/12/02 | 159,678 | 159,678 | |||||||

| 26/9/03 | 98,880 | 98,880 | |||||||

| c 21/12/04 | 165,063 | 165,063 | 613p | 21/12/07 | |||||

| Total | 326,095 | 169,566 | 26,890 | 12,802 | 455,969 | ||||

| Rona Fairhead | |||||||||

| b 19/4/02 | 933 | 933 | |||||||

| b 17/4/03 | 15,103 | 15,103 | |||||||

| b 16/4/04 | 5,146 | 5,146 | 652p | 16/4/09 | |||||

| c* 8/4/02 | 5,000 | 5,000 | |||||||

| c 16/12/02 | 159,678 | 159,678 | |||||||

| c 26/9/03 | 98,880 | 98,880 | |||||||

| c 21/12/04 | 165,063 | 165,063 | 613p | 21/12/07 | |||||

| Total | 279,594 | 170,209 | - | - | 449,803 | ||||

| Peter Jovanovich | |||||||||

| a 8/6/99 | 46,586 | 46,586 | - | 8/6/04 | 0p | ||||

| b 19/5/00 | 9,822 | 9,822 | - | ||||||

| b 3/1/01 | 58,343 | 58,343 | - | ||||||

| c* 9/5/01 | 41,560 | 12,260 | 29,300 | ||||||

| c 16/12/02 | 198,396 | 198,396 | |||||||

| c 26/9/03 | 98,880 | 98,880 | |||||||

| c 21/12/04 | 165,063 | 165,063 | 613p | 21/12/07 | |||||

| Total | 453,587 | 165,063 | 46,586 | 80,425 | 491,639 | ||||

| John Makinson | |||||||||

| a 8/6/99 | 30,874 | 30,874 | - | 8/6/04 | 0p | ||||

| b 19/5/00 | 9,117 | 9,117 | - | ||||||

| b 11/5/01 | 9,553 | 9,553 | |||||||

| b 17/4/03 | 12,210 | 12,210 | |||||||

| c* 9/5/01 | 26,380 | 7,782 | 18,598 | ||||||

| c 16/12/02 | 206,880 | 206,880 | |||||||

| c 26/9/03 | 98,880 | 98,880 | |||||||

| c 21/12/04 | 165,063 | 165,063 | 613p | 21/12/07 | |||||

| Total | 393,894 | 165,063 | 30,874 | 16,899 | 511,184 | ||||

| Total | 2,096,736 | 1,116,031 | 158,379 | 140,145 | 2,914,243 | ||||

Note 1 Prices have been rounded to the nearest whole penny.

Note 2 The number of shares shown represents the maximum number of shares that may vest, subject to any performance conditions being met.

Note 3 No variations to the terms and conditions of plan interests were made during the year.

Note 4 Restricted shares designated as: a reward plan; b annual bonus share matching plan; c long-term incentive plan; and * where shares have vested and are held pending release.

Each plan is described below in relation to its status during the year i.e. whether awards have been released or lapsed, have vested and are held, are outstanding or were granted.

Awards released The outstanding Pearson Equity Incentives awarded in 1999 under the reward plan which had previously vested were released on 8 June 2004. No consideration was payable by participants for these shares. Marjorie Scardino, David Bell, Peter Jovanovich and John Makinson held awards under these plan. Details of these awards are set out in table 4 and itemised as a.

Awards lapsed Since the earnings per share target for 1999 to 2004 was not met, the annual bonus share matching plan awards made on 19 May 2000 and the award made to Peter Jovanovich on 3 January 2001 lapsed. Marjorie Scardino, David Bell, Peter Jovanovich and John Makinson held awards under these plan. Details of these awards are set out in table 4 and itemised as b.

Awards vested and held In accordance with the terms agreed with her when she joined the company, the long-term incentive plan shares awarded to Rona Fairhead on 8 April 2002 vested in 2004 on the third anniversary of her date of her appointment pending release. No consideration is payable for these shares. Details of this award are set out in table 4 and itemised as c*.

The vesting of restricted stock awards made on 9 May 2001 was related to free cash flow per share performance over the period 2001 to 2003. The target for all of the shares awarded to vest was cumulative free cash flow per share of 116.9p and the threshold for 50% of the shares to vest was 95.9p. These represented compound annual growth rates over free cash flow per share of 23.0p in 2000 equivalent to 28.8% and 17.4%. At the end of 2003, there was an outstanding receivable due from the TSA contract in 2002. The committee deemed this to be an exceptional situation outside the control of the participants concerned and agreed that the vesting of shares be triggered by the actual reported FCF per share over the period 2001 through 2003 plus the FCF per share that would have derived from the TSA cash had it been received in 2003. The TSA receivable was collected in full in December 2004. For the purposes of the plan, this together with the actual FCF per share in 2001, 2002 and 2003 amounted to a cumulative FCF per share over the period of 104.9p giving rise to a payout of 70.5% of the shares originally awarded. The collection of the TSA receivable in 2004 had no effect on other long-term incentive awards covering that period for which other performance measures apply.

A participant may call for three-quarters of the shares that vest within six months of the vesting date being the earliest practicable date following the announcement of the 2004 results. The remaining one-quarter of the shares that vest may be called within six months of 9 May 2006, being the fifth anniversary of the original grant date, but only if the participant has not disposed of any shares in the first three-quarters, other than those that may be released in order to satisfy personal tax liabilities.

Marjorie Scardino, David Bell, Peter Jovanovich and John Makinson hold shares under this plan. Details of these awards are set out in table 4 and itemised as c*.

Awards outstanding Outstanding awards from 2001, 2002 and 2003 under the annual bonus share matching plan will vest subject to the real growth in earnings per share targets being met for the relevant three or five year periods. For the award made in 2002, the three-year earnings per share target for 2001 to 2004 was met. Marjorie Scardino, David Bell, Rona Fairhead, Peter Jovanovich and John Makinson hold awards under this plan. Details are set out in table 4 and itemised as b.

The long-term incentive plan shares awarded on 16 December 2002 and 26 September 2003 will vest in tranches. The first tranche of the shares granted in 2003 will vest on 28 June 2005 and the first tranche of the shares granted in 2004 will vest on 26 September 2006. The second, third, fourth and fifth tranches of the shares granted in 2003 will vest no earlier than 28 June 2005 subject to the Pearson share price reaching £9, £11, £13 and £18 respectively for a period of 20 consecutive business days prior to 28 June 2009. The second, third, fourth and fifth tranches of the shares granted in 2004 will vest no earlier than 26 September 2006 subject to the Pearson share price reaching £9, £11, £13 and £18 respectively for a period of 20 consecutive business days prior to 26 September 2010.

Marjorie Scardino, David Bell, Rona Fairhead, Peter Jovanovich and John Makinson hold shares under this plan. Details are set out in table 4 and itemised as c.

Awards granted The annual bonus share matching plan shares awarded on 16 April 2004 will vest in full on 16 April 2009 if the company's adjusted earnings per share increase in real terms by at least 3% per annum over the period 2003 to 2008. Half this number of shares will vest on 16 April 2007 if the company's adjusted earnings per share increase in real terms by at least 3% per annum over the period 2003 to 2006. The market price of the shares on the date of the award was 652p. The latest vesting date of this award is 16 April 2009. David Bell and Rona Fairhead hold shares under this plan. Details of these awards are set out in table 4 and itemised as b.

The long-term incentive plan shares awarded on 5 May 2004 to Dennis Stevenson were in lieu of part of his total pay as noted in table 1 of this report. The shares will vest on 5 May 2007 subject to the Pearson share price reaching £9 for a period of 20 consecutive business days prior to 5 May 2007. Details of this award are set out in table 4 and itemised as c.

The shares awarded on 21 December 2004 were based on three performance measures: relative total shareholder return, return on invested capital, and an earnings per share and sales growth matrix. The award is split equally across all three measures.

For relative total shareholder return, the comparator group is all the constituents of the FTSE World Media Index. Total shareholder return will be measured over the three-year period 2004 to 2007 based on the period immediately following the 2003 results announcement to the period immediately following the 2006 results announcement. Subject to the Committee satisfying itself that the recorded total shareholder return is a genuine reflection of the underlying financial performance of the business, the award will vest in full if Pearson's total shareholder return relative to this group of companies is ranked at the upper quartile or better. Two-fifths of the award will vest at the median. No part of the award will vest for performance below median.

For return on invested capital, the award will vest in full if Pearson's 2006 return on invested capital is 8.0% or better. A quarter of the award will vest for return on invested capital of 6.5%. No part of the award will vest for return on invested capital below 6.5%.

For sales and earnings per share growth, the measures work inter-dependently i.e. this element does not pay out at all unless there is growth in both sales and EPS. The threshold for payout, at which 30% of the award vests, is real growth in both sales and EPS. Subject to threshold performance being achieved, this element of the award pays out in full only for significant (defined as double-digit) growth in either sales or EPS or good growth (defined as being between real and double-digit) in both.

The market price of the shares on the date of the award was 613p. The latest vesting date of this award is 21 December 2007. A participant may call for three-quarters of the shares that vest within six months of the vesting date. However, the remaining one-quarter of the shares that vest may be called within six months of the second anniversary of the vesting date but only if the participant has not disposed of any shares in the first three-quarters, other than those that may be released in order to satisfy personal tax liabilities.

Marjorie Scardino, David Bell, Rona Fairhead, Peter Jovanovich and John Makinson hold shares under this plan. Details of these awards are set out in table 4 and itemised as c.

| Date of grant | 1 Jan 04 | Granted | Exercised | Lapsed | 31 Dec 04 | Option price | Earliest exercise date | Expiry date | Price on exercise | Gain on exercise |

|---|---|---|---|---|---|---|---|---|---|---|

| Dennis Stevenson | ||||||||||

| b 15/5/98 | 2,512 | 2,512 | - | 687p | ||||||

| b 30/4/04 | - | 3,556 | 3,556 | 494.8p | 1/8/11 | 1/2/12 | ||||

| Total | 2,512 | 3,556 | - | 2,512 | 3,556 | |||||

| Marjorie Scardino | ||||||||||

| a* 14/9/98 | 176,556 | 176,556 | 974p | 14/9/01 | 14/9/08 | |||||

| a* 14/9/98 | 5,660 | 5,660 | 1090p | 14/9/01 | 14/9/08 | |||||

| b 15/5/98 | 2,839 | 2,839 | 687p | 1/8/05 | 1/2/06 | |||||

| b 9/5/03 | 2,224 | 2,224 | 425p | 1/8/06 | 1/2/07 | |||||

| c 8/6/99 | 37,583 | 37,583 | 1373p | 8/6/02 | 8/6/09 | |||||

| c 8/6/99 | 37,583 | 37,583 | 1648p | 8/6/02 | 8/6/09 | |||||

| c 8/6/99 | 37,583 | 37,583 | 1922p | 8/6/02 | 8/6/09 | |||||

| c 3/5/00 | 36,983 | 36,983 | 2764p | 3/5/03 | 3/5/10 | |||||

| c 3/5/00 | 36,983 | 36,983 | 3225p | 3/5/03 | 3/5/10 | |||||

| d* 9/5/01 | 41,550 | 41,550 | 1421p | 9/5/02 | 9/5/11 | |||||

| d* 9/5/01 | 41,550 | 41,550 | 1421p | 9/5/03 | 9/5/11 | |||||

| d* 9/5/01 | 41,550 | 41,550 | 1421p | 9/5/04 | 9/5/11 | |||||

| d 9/5/01 | 41,550 | 41,550 | 1421p | 9/5/05 | 9/5/11 | |||||

| Total | 540,194 | - | - | - | 540,194 | |||||

| David Bell | ||||||||||

| a* 14/9/98 | 20,496 | 20,496 | 974p | 14/9/01 | 14/9/08 | |||||

| b* 15/5/98 | 501 | 501 | - | 687p | ||||||

| b* 16/5/99 | 184 | 184 | 913p | 1/8/04 | 1/2/05 | |||||

| b 13/05/00 | 202 | 202 | - | 1428p | ||||||

| b* 9/5/01 | 202 | 202 | 957p | 1/8/04 | 1/2/05 | |||||

| b 10/5/02 | 272 | 272 | 696p | 1/8/05 | 1/2/06 | |||||

| b 9/5/03 | 444 | 444 | 425p | 1/8/06 | 1/2/07 | |||||

| b 30/4/04 | - | 1,142 | 1,142 | 494.8p | 1/8/07 | 1/2/08 | ||||

| c 8/6/99 | 18,705 | 18,705 | 1373p | 8/6/02 | 8/6/09 | |||||

| c 8/6/99 | 18,705 | 18,705 | 1648p | 8/6/02 | 8/6/09 | |||||

| c 8/6/99 | 18,705 | 18,705 | 1922p | 8/6/02 | 8/6/09 | |||||

| c 3/5/00 | 18,686 | 18,686 | 2764p | 3/5/03 | 3/5/10 | |||||

| c 3/5/00 | 18,686 | 18,686 | 3225p | 3/5/03 | 3/5/10 | |||||

| d* 9/5/01 | 16,350 | 16,350 | 1421p | 9/5/02 | 9/5/11 | |||||

| d* 9/5/01 | 16,350 | 16,350 | 1421p | 9/5/03 | 9/5/11 | |||||

| d* 9/5/01 | 16,350 | 16,350 | 1421p | 9/5/04 | 9/5/11 | |||||

| d 9/5/01 | 16,350 | 16,350 | 1421p | 9/5/05 | 9/5/11 | |||||

| Total | 181,188 | 1,142 | - | 703 | 181,627 | |||||

| Rona Fairhead | ||||||||||

| b 30/4/04 | - | 1,904 | 1,904 | 494.8p | 1/8/07 | 1/2/08 | ||||

| d* 1/11/01 | 19,997 | 19,997 | 822p | 1/11/03 | 1/11/11 | |||||

| d* 1/11/01 | 19,998 | 19,998 | 822p | 1/11/04 | 1/11/11 | |||||

| d 1/11/01 | 20,005 | 20,005 | 822p | 1/11/05 | 1/11/11 | |||||

| Total | 60,000 | 1,904 | - | - | 61,904 | |||||

| Peter Jovanovich | ||||||||||

| a* 12/9/97 | 8,250 | 8,250 | 758p | 12/9/00 | 12/9/07 | |||||

| a* 12/9/97 | 102,520 | 102,520 | 677p | 12/9/00 | 12/9/07 | |||||

| c 8/6/99 | 32,406 | 32,406 | 1373p | 8/6/02 | 8/6/09 | |||||

| c 8/6/99 | 32,406 | 32,406 | 1648p | 8/6/02 | 8/6/09 | |||||

| c 8/6/99 | 32,406 | 32,406 | 1922p | 8/6/02 | 8/6/09 | |||||

| c 3/5/00 | 33,528 | 33,528 | 2764p | 3/5/03 | 3/5/10 | |||||

| c 3/5/00 | 33,528 | 33,528 | 3225p | 3/5/03 | 3/5/10 | |||||

| d* 9/5/01 | 31,170 | 31,170 | $21.00 | 9/5/02 | 9/5/11 | |||||

| d* 9/5/01 | 31,170 | 31,170 | $21.00 | 9/5/03 | 9/5/11 | |||||

| d* 9/5/01 | 31,170 | 31,170 | $21.00 | 9/5/04 | 9/5/11 | |||||

| d 9/5/01 | 31,170 | 31,170 | $21.00 | 9/5/05 | 9/5/11 | |||||

| d* 1/11/01 | 19,998 | 19,998 | $11.97 | 1/11/03 | 1/11/11 | |||||

| d* 1/11/01 | 19,998 | 19,998 | $11.97 | 1/11/04 | 1/11/11 | |||||

| d 1/11/01 | 20,004 | 20,004 | $11.97 | 1/11/05 | 1/11/11 | |||||

| Total | 459,724 | - | - | - | 459,724 | |||||

| John Makinson | ||||||||||

| a* 6/5/94 | 56,000 | 56,000 | - | 567p | 658p | £50,960 | ||||

| a* 20/4/95 | 20,160 | 20,160 | 487p | 20/5/98 | 20/4/05 | |||||

| a* 8/8/96 | 36,736 | 36,736 | 584p | 8/8/99 | 8/8/06 | |||||

| a* 12/9/97 | 73,920 | 73,920 | 677p | 12/9/00 | 12/9/07 | |||||

| a* 14/9/98 | 30,576 | 30,576 | 974p | 14/9/01 | 14/9/08 | |||||

| b 9/5/01 | 1,920 | 1,920 | - | 957p | ||||||

| b 9/5/03 | 4,178 | 4,178 | 425p | 1/8/10 | 1/2/11 | |||||

| c 8/6/99 | 21,477 | 21,477 | 1373p | 8/6/02 | 8/6/09 | |||||

| c 8/6/99 | 21,477 | 21,477 | 1648p | 8/6/02 | 8/6/09 | |||||

| c 8/6/99 | 21,477 | 21,477 | 1922p | 8/6/02 | 8/6/09 | |||||

| c 3/5/00 | 21,356 | 21,356 | 2764p | 3/5/03 | 3/5/10 | |||||

| c 3/5/00 | 21,356 | 21,356 | 3225p | 3/5/03 | 3/5/10 | |||||

| d* 9/5/01 | 19,785 | 19,785 | 1421p | 9/5/02 | 9/5/11 | |||||

| d* 9/5/01 | 19,785 | 19,785 | 1421p | 9/5/03 | 9/5/11 | |||||

| d* 9/5/01 | 19,785 | 19,785 | 1421p | 9/5/04 | 9/5/11 | |||||

| d 9/5/01 | 19,785 | 19,785 | 1421p | 9/5/05 | 9/5/11 | |||||

| Total | 40,9773 | - | 56,000 | 1,920 | 351,853 | £50,960 | ||||

| Total | 1,653,391 | 6,602 | 56,000 | 5,135 | 1,598,858 | £50,960 | ||||

Note 1 Prices have been rounded to the nearest whole penny.

Note 2 No variations to the terms and conditions of share options were made during the year.

Note 3 Shares under option are designated as: a executive; b worldwide save for shares; c premium priced; and d long-term incentive; and * where options are exercisable.

a Executive - The plans under which these options were granted were replaced with the introduction of the Long-Term Incentive Plan in 2001. No executive options have been granted to the directors since 1998 and the terms set out below relate to options already granted that remain outstanding.

Subject to any performance condition being met, executive options become exercisable on the third anniversary of the date of grant and lapse if they remain unexercised at the tenth. Options granted prior to 1996 are not subject to performance conditions representing market best practice at that time.

The exercise of options granted since 1996 is subject to a real increase in the company's adjusted earnings per share over any three-year period prior to exercise. This measure of performance represented market best practice and was in accordance with institutional investors' guidelines for option plans of that period.

Real growth is measured against the UK Government's Index of Retail Prices (All Items).

Marjorie Scardino, David Bell, Peter Jovanovich and John Makinson hold options under this plan. Details of these awards are set out in table 5 and itemised as a.

b Worldwide save for shares - The acquisition of shares under the worldwide save for shares plan is not subject to the satisfaction of a performance target.

Dennis Stevenson, Marjorie Scardino, David Bell, Rona Fairhead and John Makinson hold options under this plan. Details of these holdings are set out in table 5 and itemised as b.

c Premium priced - The plan under which these options were granted was replaced with the introduction of the Long-Term Incentive Plan in 2001. No premium priced options have been granted to the directors since 1999 and the terms set out below relate to options already granted that remain outstanding.

Subject to the performance conditions being met, Premium Priced Options (PPOs) become exercisable on the third anniversary of the date of grant and lapse if they remain unexercised at the tenth.

PPOs were granted in three tranches. For these to become exercisable, the Pearson share price has to stay above the option price for 20 consecutive days within three, five and seven years respectively. The share price targets for the three-and five-year tranches of PPOs granted in 1999 were met in 2000. In addition, for options to be exercisable, the company's adjusted earnings per share have to increase in real terms by at least 3% per annum over the three-year period prior to exercise. Real growth is measured against the UK Government's Index of Retail Prices (All Items). This target was met for the three-year period 2001 to 2004.

Marjorie Scardino, David Bell, Peter Jovanovich and John Makinson hold PPOs under this plan. Details of these awards are set out in table 5 and itemised as c.

d Long-term incentive - Options granted in 2001 were based on pre-grant earnings per share growth of 75% against a target of 16.6% over the period 1997 to 2000 and are not subject to further performance conditions on exercise.

Long-term incentive options granted on 9 May 2001 become exercisable in tranches on the first, second, third and fourth anniversary of the date of grant and lapse if they remain unexercised at the tenth. The fourth tranche lapses if any of the options in the first, second or third tranche are exercised prior to the fourth anniversary of the date of grant.

Long-term incentive options granted on 1 November 2001 become exercisable in tranches on the first, second and third anniversary of the date of grant and lapse if they remain unexercised at the tenth.

Details of the option grants under this plan for Marjorie Scardino, David Bell, Rona Fairhead, Peter Jovanovich and John Makinson are set out in table 5 itemised as d.

In addition, Marjorie Scardino and Peter Jovanovich both contribute US$1,000 per month (the maximum allowed) to the US employee stock purchase plan. The terms of this plan allow participants to make monthly contributions for one year and to acquire shares at the end of that period at a price that is the lower of the market price at the beginning or the end of the period, both less 15%.

Reuben Mark, Director

27 February 2005