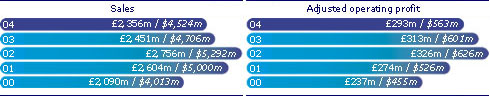

Pearson Education had a strong year, growing sales by 4% and profits by 5% in spite of the weakest US new adoption market* for five years. Our School business increased profits by 2%, our US Higher Education business grew ahead of its industry and our Professional business increased profits by 30%.

Our School business ended the year with sales level with 2003 and profits up 2%. In a year when new adoption spending fell by some 40% to approximately $500m we led the new adoption market, taking a 27% share of this smaller new adoption opportunity - or 30% of the adoption opportunities we participated in. We benefited from our strength across a wide range of subjects and grade levels, with a decline in elementary sales (after particularly strong market share growth in 2003) mitigated by a strong performance in the secondary market. We returned to growth in the open territories and in supplementary publishing, helped by the restructuring actions we took in 2003 and by the sharp recovery in US state budgets. We also invested in major new programmes in reading, science, literature and social studies, which should help us capture a good share of a strong US School market over the next few years.

Our US School testing business benefited from the start-up of a number of new state contracts, including Texas, Ohio, Virginia and Washington. We continued to win new multi-year contracts, worth $150m, including Tennessee, New Jersey and California ahead of implementation of the No Child Left Behind Act testing requirements, which become mandatory in the school year starting in September 2005. Our digital learning businesses showed a further profit improvement on slightly lower sales and we continued to develop and sell new products which integrate our content, testing and technology in a more focused way. The decline in reported profits reflects the impact of dollar weakness and a full year contribution from Edexcel, which is loss-making in the first half.

Our Higher Education business grew sales by 4% and profits by 1%. In the US we grew faster than the market for the sixth straight year, up 4% while the industry without Pearson was up 2%, according to the Association of American Publishers. We saw particular strength in two-year career colleges, a fast-growing segment, with vocational programmes in allied health, technology and graphic arts, and elsewhere in maths and modern languages.

Our margins eased a little as we achieved 5% growth outside the US and continued to invest to make our technology central to the teaching and learning process. We rolled out our online learning platforms into new subject areas including economics, psychology and modern languages and by the end of the year almost three million US college students were following their courses through one of our online programmes. Our custom publishing business, which creates specific programmes built around the curricula of individual faculties or professors, grew very strongly. Pearson Custom has now increased its sales eight-fold over the past six years and we have introduced our first customised online resources for individual college courses.

Recognising concern over the rising cost of higher education, we also accelerated our strategy of making our content available to students in a wide range of different formats and price points through our Pearson Choices programme (www.pearsonchoices.com). Through SafariX, 350 of our leading textbooks are now available to students in a web-based format, at half the price of their traditional print counterparts.

Our Professional education business grew sales by 12% and profits by 30%. Pearson Government Solutions grew sales by 25%, with strong growth from add-ons to existing programmes. We also won some important new contracts, including multi-year contracts worth $500m from customers such as the US Department of Health and the London Borough of Southwark. Our Professional Testing business grew sales 31% as we benefited from the start-up of major new contracts although we continued to operate at a small loss as we invested in building up the infrastructure for our 150-strong UK test centre network. Markets remained tough for our technology publishing titles, where sales were 6% lower, but profits were broadly level as a result of further cost actions.

Our education businesses outside the US contributed a record $1.2bn in revenues. We saw a series of good performances across the spectrum of our publishing, testing and software. We won $200m of multi-year school testing contracts outside the US. Edexcel successfully introduced our testing technology into the UK, marking 1.3 million examination scripts on-screen in 2004. Our international English Language Teaching business grew well, helped by our biggest ever ELT investment. The new programme, English Adventure, has been developed for primary school age students using Disney characters, and has now been launched in five major ELT markets with a plan to go to over 50 in the next few years.

Pearson Education completed a number of small bolt-on acquisitions in the year. These included Knowledge Analytic Technologies, extending our capabilities in electronic school testing and marking; Causeway Press, strengthening our UK education publishing for schools and colleges; Altona Ed, a web-based student information system; and Dominie Press in Spanish language supplementary publishing.

* Note In the US, 20 'adoption' states buy textbooks and related programmes on a planned contract schedule or 'adoption cycle'. The level of spending varies from year to year with this schedule, depending on the number of adoptions in the largest states and subjects. In 'open territory' states, school districts or individual schools buy textbooks according to their own individual schedules rather than on a statewide basis.

| Sales | 2004 £m |

2004 $m |

2003 £m |

2003 $m |

Change - underlying % |

|---|---|---|---|---|---|

| School | 1,118 | 2,147 | 1,176 | 2,258 | - |

| Higher Education | 731 | 1,404 | 772 | 1,482 | 4 |

| Professional | 507 | 973 | 503 | 966 | 12 |

| Total | 2,356 | 4,524 | 2,451 | 4,706 | 4 |

| Adjusted operating profit | |||||

| School | 117 | 225 | 127 | 244 | 2 |

| Higher Education | 133 | 255 | 148 | 284 | 1 |

| Professional | 43 | 83 | 38 | 73 | 30 |

| Total | 293 | 563 | 313 | 601 | 5 |