Penguin had a difficult year, with flat sales and significantly lower profits, despite a successful publishing schedule. The single largest factor in the decline in reported operating profit was the weak dollar. Penguin makes approximately two-thirds of its sales in the US and the dollar's decline against sterling reduced Penguin's profits by £14m. The 24% decline in underlying operating profit was caused by a number of factors, including disruption to our UK distribution and weakness in the US consumer publishing market.

In the UK, our move to a new warehouse, to be shared between Penguin and Pearson Education, disrupted supply of our books and had a particular impact on backlist titles. Although we traded well in the second half, and shipped more books to our UK customers than in the previous year, we incurred some £9m of additional costs as we took special measures to deliver books, including the cost of running two warehouses, shipping books direct and additional marketing support. By the end of the year, we had eliminated the order backlog in the warehouse, and the new management team has continued to make good progress in the early part of 2005, successfully installing the new automated warehouse management system. We will continue to incur dual running costs until Pearson Education moves into the new warehouse, which is planned for the second half.

After a good start to the year, the US consumer publishing market deteriorated sharply in the second half and full-year industry sales were 1% lower than in 2003, according to the Association of American Publishers. The adult mass market segment, which accounts for approximately one-third of Penguin's US sales, was down 9% for the industry for the full year, and 13% in the second half. Penguin is planning for 2005 on the basis that tough market conditions continue and is adjusting its business and publishing programmes accordingly. We are taking actions to reduce costs, accelerating investment in successful new imprints, focusing publishing in premium market categories and finding new ways to sell high margin backlist titles.

Despite this, Penguin had another great publishing year. We benefited from our new imprint strategy, with a further four imprints publishing for the first time. Non-fiction performed particularly well, with a 40% increase in our titles on the New York Times bestseller list, including Lynne Truss's Eats, Shoots & Leaves (now with over one million copies in print), Ron Chernow's Alexander Hamilton and Maureen Dowd's Bushworld. Best-selling UK titles included Jamie Oliver's Jamie's Dinners, Sue Townsend's Adrian Mole and the Weapons of Mass Destruction and Gillian McKeith's You Are What You Eat.

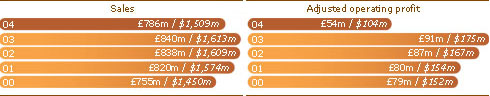

| 2004 £m |

2004 $m |

2003 £m |

2003 $m |

Change - underlying % |

|

|---|---|---|---|---|---|

| Sales | 786 | 1,509 | 840 | 1,613 | - |

| Adjusted operating profit | 54 | 104 | 91 | 175 | (24) |