The Financial Times Group increased sales by 3% and profits by 69% with another good year from IDC, a more stable business advertising environment and the benefit of cost actions taken in recent years.

The Financial Times achieved revenue growth for the first year since 2000 and reduced losses from £32m in 2003 to £9m, returning to profit in the seasonally strong fourth quarter. Sales increased 3% with advertising revenues up 2% and circulation revenues also ahead.

Advertising performance across categories and regions was mixed throughout the year. While the recruitment and luxury goods categories increased by more than 20%, the business-to-business and technology sectors showed few signs of recovery. In terms of geography, good growth in Europe and Asia offset a very weak US corporate advertising market. We continued to reduce the FT's cost base, which is now £110m or one-third lower than it was in 2000. At the same time, we invested in editorial initiatives, printing the FT in Australia - a first for any international daily newspaper publisher - and increasing the reach and number of our colour magazines, FT Magazine and How To Spend It. Average circulation for the year of 435,000 was 3% lower than the previous year, while FT.com has 76,000 paying subscribers and 3.7 million unique users. The FT's performance in international surveys of business readership in print and online remained strong.

Les Echos achieved sales growth of 4% and profits grew very strongly, despite a volatile advertising market. Average circulation grew 3% to 119,800, while competitors continued to see falling sales. FT Business also posted significant profit growth, with sales growth across all its main markets, and a continuing emphasis on cost management.

Profit from the FT's associates and joint ventures doubled in the year. Losses narrowed at FT Deutschland as circulation and advertising revenue both grew strongly. FT Deutschland reached the 100,000 copy sales mark in December, and circulation averaged 96,600 (+6%). The Economist Group again increased its operating profit, with The Economist's circulation passing the significant one million mark, with an average weekly circulation of 1,009,759. The Group also launched a new annual, Intelligent Life, as well the first Chinese language edition of The World in 2005.

Interactive Data Corporation (NYSE: IDC), our 61%-owned financial information business, increased sales by 3% and profits by 9%. FT Interactive Data and e-Signal performed well, particularly in the US, where we saw some signs of improvement in market conditions. Worldwide renewal rates among institutional clients remained at or above 95%. Demand for Interactive Data's value-added services remained strong, with the signing of our 100th customer for our Fair Value Information Service product in December. IDC had a first full year contribution from acquisitions made in 2003, ComStock and Hyperfeed Technologies, and acquired FutureSource in September to expand and complement e-Signal. The consolidation of seven US data centres into two facilities is on track for completion at the end of this year.

In December, we announced our intention to sell our shareholding in Recoletos, our 79%-owned Spanish media group, to Retos Cartera as part of a tender offer for all of Recoletos. Retos Cartera's tender offer was launched on 16 February 2005 and we accepted it on 25 February. In January 2005, we also accepted an offer from Dow Jones & Co. for our 22% stake in MarketWatch, bringing in proceeds of $101m.

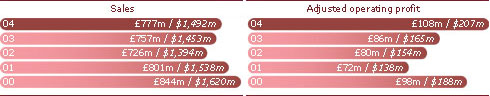

| Sales | 2004 £m |

2004 $m |

2003 £m |

2003 $m |

Change - underlying % |

|---|---|---|---|---|---|

| FT Newspaper | 208 | 399 | 203 | 390 | 3 |

| Other FT publishing | 110 | 211 | 112 | 215 | 5 |

| IDC | 269 | 517 | 273 | 524 | 3 |

| Total continuing | 587 | 1,127 | 588 | 1,129 | 3 |

| Discontinued (Recoletos) | 190 | 365 | 169 | 324 | 15 |

| Total | 777 | 1,492 | 757 | 1,453 | 6 |

| Adjusted operating profit/(loss) | |||||

| FT Newspaper | (9) | (17) | (32) | (62) | 72 |

| Other FT publishing | 11 | 21 | 6 | 11 | 61 |

| Associates and joint ventures | 6 | 11 | 3 | 6 | 100 |

| IDC | 78 | 150 | 81 | 156 | 9 |

| Total continuing | 86 | 165 | 58 | 111 | 69 |

| Discontinued (Recoletos) | 22 | 42 | 28 | 54 | (18) |

| Total | 108 | 207 | 86 | 165 | 39 |